From Intern to Certified AWS Solutions Architect: My Journey at Sciurus Analytics

When I joined Sciurus Analytics Ltd. in February 2022, I was a fresh graduate stepping into the vast and exciting world of cloud computing. AWS, a cornerstone of cloud technology, was unfamiliar territory for me at the time. Over the past three years, Sciurus Analytics has been my training ground—a place where I not only developed my AWS expertise but also grew into a certified AWS Solutions Architect.

This blog is a reflection on my journey, detailing the technical backbone of Sciurus Analytics, how AWS empowers our operations, and my personal growth as part of the team.

Marine Ecosystem Conservation

During my time as an intern at Global Reef in Koh Tao, I had the incredible opportunity to participate in data collection for several research projects aimed at conserving complex marine ecosystems and preserving biodiversity. This internship not only enhanced my understanding of coral biology but also allowed me to engage in hands-on conservation efforts to protect our fragile reefs......

A Journey with GPT-4 to Glean Pension Data (Part II)

The newly developed custom GPTs greatly improved the efficiency at which annual reports can be located and analysed. However, for companies like Financial Canvas, the vast amount of data required for meaningful insights means that despite the assistance of AI tools, considerable user effort and time are still necessary, particularly for tasks like trimming PDF documents….

A Journey with GPT-4 to Glean Pension Data (Part I)

The evolution of artificial intelligence has led to Chat-GPT4 emerging as a transformative force in the space of financial analysis. In particular, the analysis of complex financial annual reports.

With the additional capability for GPT-4 to process PDF documents, a feature incorporated in mid-2023, and the continuous improvement of GPT’s performance, the technology is primed for widespread integration in various financial applications.

So, can GPT-4 take an annual report for a company and glean specific information about their pension funds from it? The short answer…

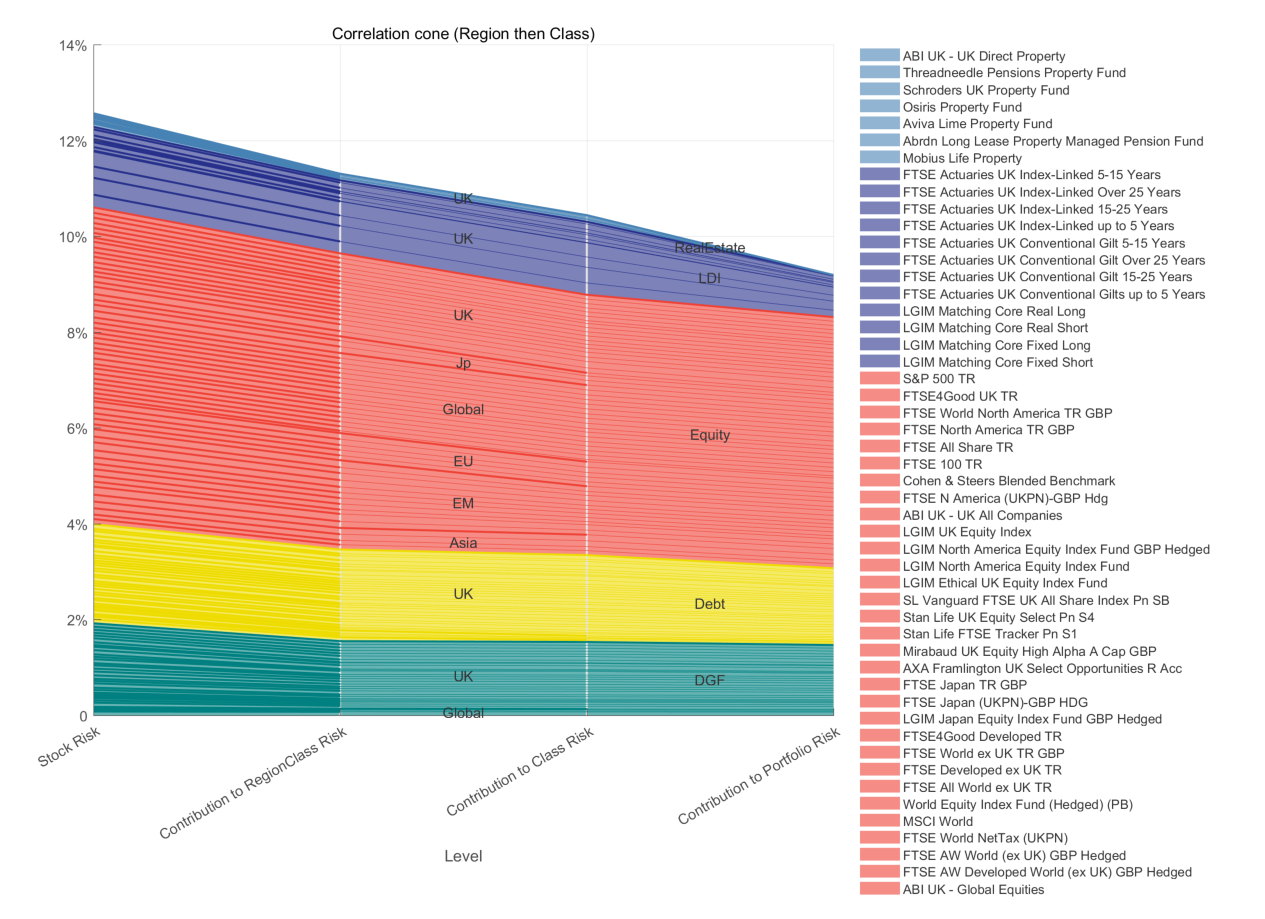

Introducing The Correlation Cone, a New Way to Visualise Your Risk

I’ve been working at Financial Canvas now for nearly two years and am having great fun learning about risk modelling and software development using a range of analytic and web-based programming languages to carry out calculations and bring the analysis to life.

We help our clients to calculate and visualise their investment and actuarial risks, and I’m excited to share a new way of doing that, which we are calling “the Correlation Cone”. …

Changing Role in Revolutionizing the Industry

The financial industry has long been at the forefront of technological innovation, and in recent years, the role of artificial intelligence (AI) has become increasingly prominent. AI’s influence on finance is profound and transformative, with applications ranging from risk assessment and fraud detection to algorithmic trading and customer service….

CHRISTMAS READING FROM THE PENSIONS REGULATOR... (AND CODING THE CODE!)

There was no need to worry about receiving a good book from loved ones this Christmas (as it happens I got a very good one from my brother about the greeks - the ancient ones, rather than the option pricing derivatives, but that's for another message) with plenty to peruse and ponder from our friends at the Pensions Regulator…

INTERNING AT FINANCIAL CANVAS AND OUR NEW CORRELATION CHARTS!!

Hello World! This is Oscar Squirrell and Sam Twite with our first blog working for Financial Canvas. We are both A-Level students working at Financial Canvas over the summer seeing how our maths and, respectively, economics and computer science is applied in the real world…

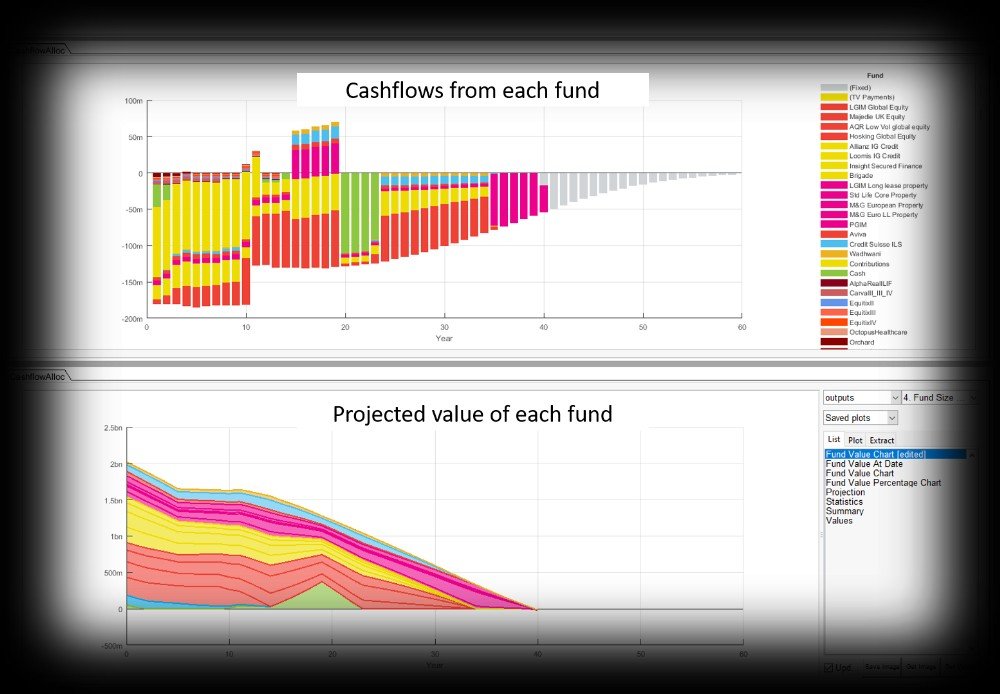

CDI EXPLORER - NEW MODEL DEVELOPED WITH MOMENTUM INVESTMENT SOLUTIONS & CONSULTING!

Have you been following the CDI debate or looking at alternatives to Gilts based funding measures?

Moving away from traditional actuarial valuations and focusing explicitly on a pension scheme’s ability to meet its cashflow requirements can lead to some interesting observations...

INTERNING AT SCIURUS ANALYTICS AND EXPLORING FINANCIAL CANVAS AS A TOOL FOR ANALYSING TIME SERIES

My first year studying Mathematics has given me a great foundation to build on, but I wanted to see the maths I’ve learned being used in real-life. Interning at Sciurus Analytics, a start-up based in a lively co-working space in Wimbledon, for a few weeks this summer, has given me insight into the ways I might use my degree once I’ve graduated. I’ve seen daily stand-ups and agile working, as well as had the opportunity to explore applications of mathematics in a business context.

IMPROVE YOUR ANALYTICS OR THE UI/UX?

At a client review meeting recently, I caught up with Rob Gardner at the café below Redington’s impressive new office, just a few minutes’ walk from Bank Station in the heart of the City.

Rob was outlining how Financial Canvas can help Redington to deliver their ambitious aim to bring financial security to 100 million people. As we chatted, jotted and sketched, Rob created this delightfully simple grid that formed the basis of our conversation for the rest of the meeting.

REUSABLE CHARTS AND EXTENSIBLE FRAMEWORKS

Another great blog from our John Walley and his amazing work creating online dashboards for Financial Canvas clients... Contact us today to build a dashboard for you.

A few months ago, I wrote about reusable charts. The thinking behind the blog post fed into the initial design for a new web application - Financial Canvas Studio. It helps professionals in the pension industry understand their financial models and the assumptions that go into them - leading to smarter decisions.

CASHFLOW NEGATIVE? DON’T IGNORE IT!

We were interested in the comments from PSolve “Cashflow Negative? Don’t worry about it!”

Whilst we appreciate the sentiment – and that might be the right advice in many circumstances – don’t forget that as benefit payments start to grow a dangerous black hole awaits.

We believe that Trustees ignore cashflows at their peril!

INTEGRATED RISK MANAGEMENT IN PRACTICE

We were delighted to see the article in the Actuary this month looking at the impact of including covenant risk in asset liability modelling for defined benefit pension schemes and thank the authors for bringing this important topic to a wider audience.

Our mission is to create easy online access to these tools for all schemes. Technology is the great enabler of our age and we believe that all trustees should be able to access this advice based on their circumstances and presented in a clear and engaging fashion so that they can make funding and investment decisions with confidence.

TECH FIRM PROMISES LOW-COST, FLEXIBLE ECONOMIC SCENARIO GENERATOR

UK-based financial analytics provider Financial Canvas is promising insurers a flexible and easy-to-use economic scenario generator (ESG) that could save them hundreds of thousands of pounds a year.

Established by Chris Squirrell, a former head of ALM modelling and stochastic valuation at Aon Consulting, Financial Canvas has been working with pension schemes, life insurers and advisors since 2013 to provide analytics solutions, including an alternative to the off-the-shelf ESGs that currently dominate the market.

Many of the existing ESG solutions are difficult to understand, slow to calibrate and are hard to use for decision-making, Squirrell said. “We wanted to create a model that had all the features that people wanted, but is easy to set assumptions.

FINANCIAL CANVAS STUDIO – INVESTIBLE BENCHMARK – SHORT DEMO

More from financial-canvas-studio helping trustees make better decisions with confidence. Watch this trailer to see our web-based dashboards at work and comment here if you’d like to see this analysis for your scheme. How robust is your LDI solution?!

HELP DESIGN OUR NEXT UPDATE

Deciding on design and features for any software always benefits from getting the users involved. In this post we’ll give a quick update on the Studio, our online charting environment, before passing the reins over to you and asking for your input on the first of many design questions we will be posing.

The ESG (Economic Scenario Generator) dashboard helps our clients understand the nature of the simulations that we/they have generated. What features does it include? Does it capture your views correctly so that you can use it to test and compare different investment strategies?

MOMENTUM INVESTMENT SOLUTIONS & CONSULTING CHOOSES FINANCIAL CANVAS

Financial Canvas are delighted to announce that Momentum Investment Solutions & Consulting (Momentum ISC), part of Momentum Global Investment Management, has become the latest firm to sign up to use the Financial Canvas ESG and risk modelling platform.

Momentum ISC is built up of an experienced team of investment consultants who provide independent advice to UK pension schemes

Financial Canvas is a drag-and-drop environment for building and running actuarial and investment models. The graphical nature of the software makes it easy for users to see, understand and change their models.

Adding the power of Financial Canvas will help Momentum ISC to deliver leading edge liability driven investment advice and bring new ideas to their clients.

FINANCIAL CANVAS UPDATE – THE STUDIO

Work on the studio continues apace.

The Studio is our online charting environment where clients can access interactive dashboards of models designed and built on the Financial Canvas servers.

I’m delighted to welcome John Walley to the team who is helping us to implement a smart new dashboard framework taking the best from React and the d3js libraries. John brings a wealth of experience in software development and a passion for data visualisation – see his blog on React/d3 for some of the technical details…

ALL MODELS ARE WRONG …

I was reading Amy Kessler’s excellent article in Professional Pensions this morning ‘Understanding the limitations of the CMI longevity model’.

Amy is right to remind us that the model has limitations. All models do; they are necessarily and by definition, simplifications of reality. (For the time being anyway until we can run simulations of reality within the simulation of reality that we all ‘exist’ if you subscribe to the hypothesis popularised by Elon Musk recently…). I digress.