CHRISTMAS READING FROM THE PENSIONS REGULATOR... (AND CODING THE CODE!)

There was no need to worry about receiving a good book from loved ones this Christmas (as it happens I got a very good one from my brother about the greeks - the ancient ones, rather than the option pricing derivatives, but that's for another message) with plenty to peruse and ponder from our friends at the Pensions Regulator... With thanks to Sackers for collating this list in their excellent summary:

Four key documents have been published by TPR as part of a funding package:

the draft code itself

a consultation document on the parameters for submitting Fast Track valuations, and

TPR’s response to part one of the consultation on revising the draft code dating back to March 2020.

There is also a press release and a blog from TPR’s David Fairs

It's made a lot of interesting reading - and a little Christmas coding...

For those of you wondering "what might Fast Track look like for us", our clients can be assured that the information will be at your fingertips.

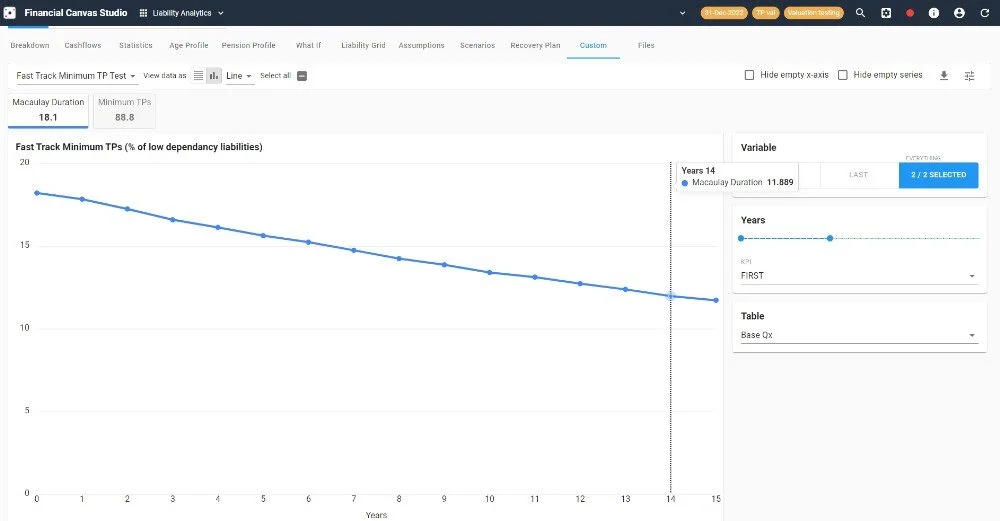

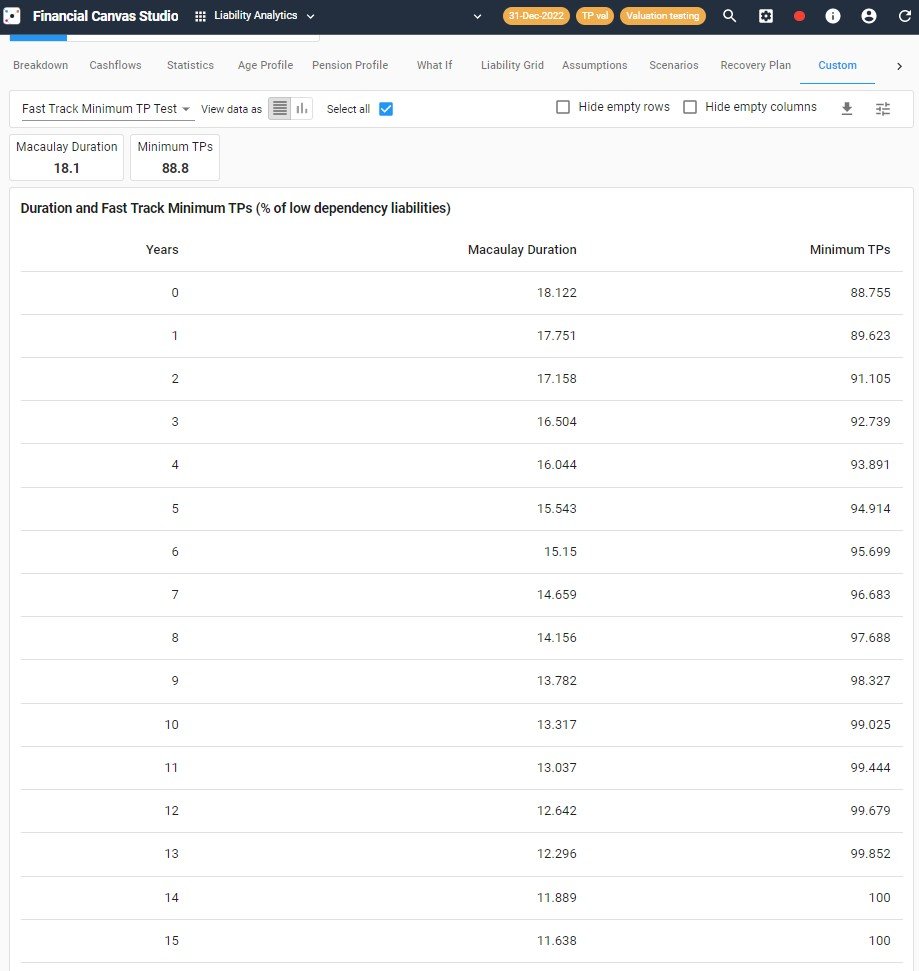

Here's a sneak peak showing when the Macaulay duration hits "significant maturity" for a sample scheme on the Financial Canvas platform and how the Minimum Technical Provisions increase to the the low dependency liabilities over the next 14 years (in this case).

All terms and calculations we will become very familiar with over the coming months I'm sure! We're working hard to make the new process as simple as possible for everyone to follow.

If you're already a client, then keep an eye on the coming releases, and if you're not yet then please get in touch if you'd like access to all the new funding code calculations for your scheme(s).

In the meantime, a Happy New Year to everyone from the team at Financial Canvas :)

Projected Macaulay duration

Note this scheme is projected to hit significant maturity in just under 14 years.

Along with the corresponding Fast Track minimum TPs

From the table in the Regulator's consultation document

The numbers

This scheme's TP's would need to be at least 88.755% of the Fast Track low dependency liabilities to pass this Fast Track test.